Independent Contractor vs. Employee

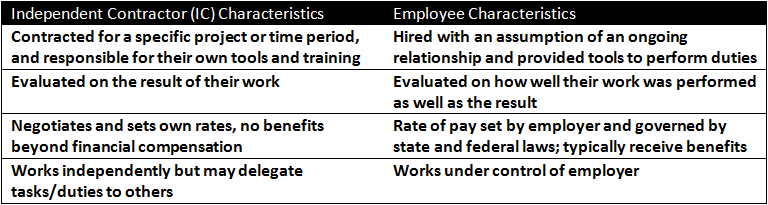

Several key factors can be used to distinguish the difference between the classification types.

Other factors and helpful questions to consider for independent contractor classification include:

BEHAVIOR : Does the company dictate control?

Independent contractors are not subject to control or guidance. The independent contractor decides how to provide the contracted services and determines their hours of work, work site and equipment.

FINANCIAL : Are the business aspects controlled by the company?

Independent contractors provide their own training and tools, and are responsible for their own costs and expenses.

RELATIONSHIP TYPE : How is the relationship governed and are benefits provided?

The relationship with the independent contractor is not an employment relationship, rather a contractual arrangement exists. Independent contractors perform a specific project, are paid in accordance to the agreement, do not receive benefits beyond their financial compensation, and are not eligible for unemployment or workers’ compensation.

While these factors are high-level guidelines, there are still quite a few grey areas that can be tricky to navigate without implementing independent contractor management best practices. No one factor stands alone in making this determination. It’s vital to look at the entire relationship and consider the degree or extent of the company’s right to direct and control the independent contractor’s services.

Maintain an Arm’s Length Relationship to Help Mitigate Risk

Adhering to best practices regarding classification and verifying documentation remains up-to-date is crucial for compliance. Companies conducting business with independent contractors need to be prepared for an audit and have the required documentation to support their position of ‘an arm’s length relationship’.

Here are some additional best practices to help ensure compliance is maintained:

- Develop a company-wide independent contractor policy to ensure a distinct and separate relationship

- Verify your independent contractors have an established business entity with a business name and EIN to make invoiced payments

- Negotiate rates for service, agreed upon by both parties and outlined in a signed contract with a detailed statement of work and a non-renewable contract end date

Trying to achieve compliance without a systematic approach can put your business at risk. One way to reduce this risk is to leverage a technology and services provider like Openforce. Openforce product and services have streamlined onboarding workflows, established documentation practices to demonstrate compliance, and processed billions in on-time settlement for tens of thousands of independent contractors. Openforce’s technology solutions integrates your best practices with custom streamlined compliance workflows specific to your business needs, then designs a complete solution to automate your current process.

Openforce is uniquely positioned to help companies leverage leading technology for the adoption and management of independent contractors to help maximize flexibility, reduce cost and mitigate risk. To learn more about how Openforce can help, contact us today.

[1] “Employers Do Not Always Follow Internal Revenue Service Worker Determination Ruling.” Treasury Inspector General for Tax Administration, June 14, 2013.

[2] “Behavioral Control” Internal Revenue Service, October 4, 2016.

[3] “Financial Control” Internal Revenue Service, October 4th, 2016.

[4] “Independent Contractor (Self-Employed) or Employee?” Internal Revenue Service, November 28, 2016.

About Openforce

Openforce is the leader in technology-driven services that reduce operating costs and mitigate risk for companies using independent contractors. Our cloud-based applications help companies and contractors alike achieve more sustainable, profitable growth by removing financial, operational, and compliance barriers to getting business done.