Nothing should be mystifying about the concept of a three-legged stool. A stool is a simple piece of furniture, and its balance depends on all three legs; if you take any one of those away, the stool falls over. It’s useless to sit on, even though it still has most of its legs left.

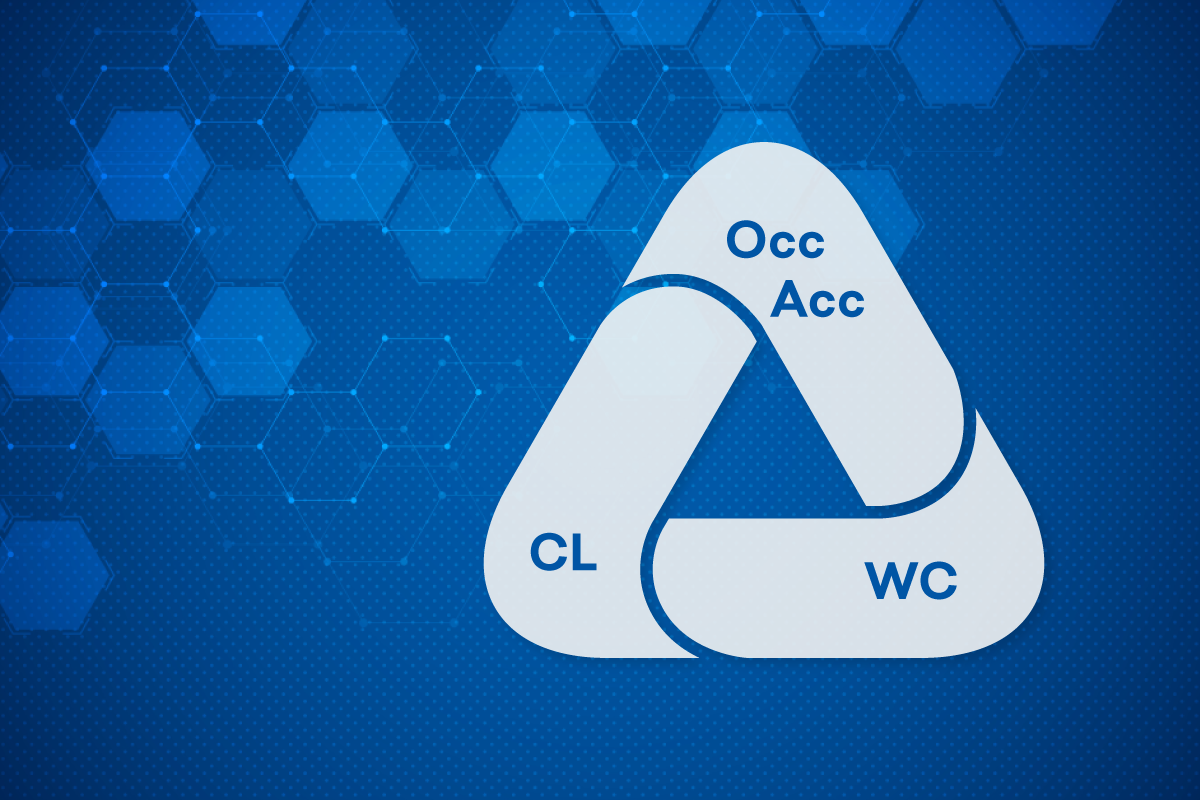

But insurance—to some an even more mystifying subject—also has its version of this three-legged concept. This metaphorical stool is made up of three types of coverage:

- Workers’ compensation.

- Occupational accident.

- Contingent liability.

These three insurance policies combine to support companies who rely on independent contractors (ICs), protecting them from a variety of risks. Without all three “legs,” you may run the risk of tipping over legally, resulting in having to pay not only for the current claim but any additional time when you did not have coverage.

Before we get into all the risks, let’s discuss the individual legs and how each one helps support the weight of a business.

Leg 1: Workers’ Compensation Insurance

Any company with employees is likely to have a workers’ compensation policy. With rare exceptions, some form of this coverage is required by law everywhere in the United States. These policies are often designed to pay the costs incurred by employees’ on-the-job injuries ad infinitum, and can therefore be pretty costly—especially for drivers, warehouse workers and any other professions with a high risk exposure.

The costs associated with workers’ compensation insurance are often the impetus for building an IC workforce in the first place. This enables you to cut out the hefty cost of covering risk for huge swaths of your workforce, right? No, not quite.

Leg 2: Occupational Accident Insurance

A company that relies on any number of ICs should probably require the contractors to obtain occupational accident insurance. Usually referred to as “OccAcc,” this type of policy acts as the frontline defense when it comes to managing the financial fallout of a work-related accident for both the involved IC and the contracting company. While it is similar to workers’ compensation insurance on the surface, this policy is specifically designed to cover an independent contractor who has an accident while on the job.

Two dangerous assumptions are often made when deciding whether to acquire occupational accident insurance: First, that only companies who work with contractors for high-risk or industrial jobs need this sort of coverage; second, that since the IC is not an employee of the contracting company, said company has no liability for the injury.

A contractor may sign a contract that says they recognize the company is not their employer, but someone who has been injured on the job is likely to find themselves racking up medical bills and other expenses while they are unable to work, so finding any route to compensation becomes their paramount concern. There are attorneys who are sensitive to this, and who may advise a contractor that a big payout could be in their future if they can present a compelling case that they were actually an employee who was misclassified as a contractor and, thus, is eligible for workers’ compensation (plus back pay and any other benefits they may have been excluded from). Anecdotal evidence suggests that judges will sometimes side with the worker who has sustained an injury and is unable to provide for their family, let alone pay medical and legal bills. If this happens, a company may be held liable despite doing nothing wrong—except deciding not to get an occupational accident plan, which is specifically designed to provide this avenue of relief for ICs.

What’s more, the legal process for such a claim involves an enormous amount of costly back and forth for both the IC—who may not see a payout for years, if at all—and you, who may end up having to pay costs associated with the claim as well as backdated workers’ compensation premiums to your insurance carrier. This is because contracting companies may be named as defendants in a claim, and have to defend themselves.

Leg 3: Contingent Liability Insurance

Contingent liability is a bit simpler than the other two, but no less important, operating as a vital coverage bridge between workers’ compensation and occupational accident policies.

This policy’s purpose is twofold: First, to retain an attorney who can defend against any claim made by an IC who is covered by an occupational accident policy; second, to pay out benefits in the event a covered contractor is found by a judge to be misclassified and entitled to the same benefits as an actual employee, due to an injury. Basically, this policy fills in the monetary gaps between the other two insurances in case of an erroneous claim.

The Stability of the Three-Legged Stool

Now you hopefully have a better understanding of how the three legs of workers’ compensation, occupational accident and contingent liability come together to support your business. Openforce simplifies this process for you by working with multiple insurance carriers that offer all three coverages. Our policies can be set up in your onboarding workflows so that ICs know exactly what they’re buying, how to make claims and more. You also have the opportunity to utilize active monitoring, legal support and settlement-deducted premiums so you can make sure coverage is always active and stay ahead of potential claims.

The best part about these policies—and buying and maintaining them through the Openforce platform—is that they’re easy and beneficial for both the contracting company and the IC. Not only do they provide benefits you can rely upon if the worst happens, but they also ensure a policy purchased in the name of the IC functions as one of their tools of the trade, alongside any physical equipment required to do the work. In short, if ICs obtain their coverage through Openforce:

- Both parties are protected from the costs of an injury sustained on the job (and any resulting claims).

- You create more separation between your business and theirs, which creates a ‘good fact’ for you in the event your company is named in a misclassification challenge.

- The contractor gains more flexibility to diversify their employer pool, because the coverage extends to any contracting company using the Openforce platform.

There’s always a temptation to forego one or more of these policies, but the risks are too great to be taken lightly. The cost of a single claim could potentially shutter an unprepared company that assumed paying for a lawsuit would just be another cost of doing business. But with all three of these insurances, you can take advantage of a stable coverage platform—one that supports your company and ICs alike, as neither party wants this particular stool to fall over.

About Openforce

Openforce is the leader in technology-driven services that reduce operating costs and mitigate risk for companies using independent contractors. Our cloud-based applications help companies and contractors alike achieve more sustainable, profitable growth by removing financial, operational, and compliance barriers to getting business done.