Ready To Unlock New Commission Revenue? Or Strengthen Your Position As Trusted Advisor?

Book a quick consultation to see why leading insurance companies, carriers, and brokers choose Openforce to help their contracting-company clients manage 1099 compliance, insurance, and payments at scale.

Our unique referral program is a win-win formula for all parties!

Generate New Commission!

Deepen Client Relationships!

Reduce Potential E&O Exposure!

Generating New Commission Is Easy.

When partners refer Openforce for 1099 contractor management and/or custom 1099 insurance programs, they don’t just earn commission, they build trust and elevate their role as a comprehensive risk advisor.

1099/ Contractor Management Software: Openforce’s all-in-one contractor management platform simplifies 1099 onboarding, insurance, and payments, eliminating manual work while strengthening compliance. By automating critical workflows and maintaining a clear, defensible audit trail, your clients gain operational efficiency and reduce exposure to worker-misclassification risk. To learn more about our contractor management solution, click here.

Custom Insurance Products Built for 1099s: Just like medical insurance, your clients can choose between in-agency or out-of-agency coverage. In-agency options include insurance offered through ICM Insurance Services, while out-of-agency coverage allows clients to use insurance placed outside of ICM. Either way, Openforce delivers full configurability to fit your clients' needs. Our technology seamlessly integrates policies to ensure independent contractors maintain proper coverage, while simplifying premium collection and preserving compliance and financial control for both clients and brokers.

OPTION #1: In-Agency Insurance

ICM Insurance Services, Openforce's sister company, offers 6 lines of coverage designed for contracting companies and independent contractors: Contingent Liability, General Liability, Motor Truck Cargo, Occupational Accident, Under Dispatch, and Workers' Compensation. To learn more, click here.

Benefits Include:

- Lower Cost to Client

- Shortened Underwriting Process (Days vs. Weeks)

- No Down Payment or Chasing Premiums

- World-Class Claims Support

OPTION #2: Out-of-Agency Insurance

As a broker, we understand you may already have insurance programs in place. They too can be integrated into our software solutions.

Benefits Include:

- Chance for Higher Upfront Commission

- Supports Established Relationships/Programs

We Do All The Heavy Lifting.

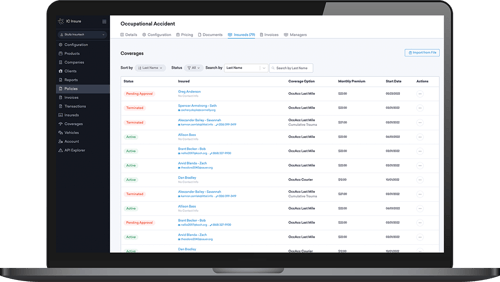

Our award-winning insurtech platform delivers seamless policy management and automated premium payments, eliminating administrative headaches, ensuring compliance, and creating a frictionless experience for both brokers and their clients.

-

Streamlined Policy Management: Say goodbye to manual spreadsheets, digital platform collects, stores, and distributes all policy documents in one convenient place.

-

Accurate, Hassle-Free Billing: We handle all billing calculations, ensuring accuracy and eliminating discrepancies for peace of mind.

-

Lower Errors and Omissions (E&O) Risk: Reduce errors and protect your business from costly mistakes and legal liabilities.

Don't Let Silence Become A Liability.

Are you increasing your E&O exposure by failing to address worker classification risk?

Recent legal precedent is clear, when brokers recognize a material risk, they have a duty to inform clients. Silence is no longer defensible. This raises a critical question: when will other risks, like worker classification, drive E&O claims? For companies using 1099 or independent contractor models, misclassification is a proven, costly risk, resulting in millions in litigation, penalties, and settlements.