Insurance Partners.

Our award-winning insurtech makes insurance easy, while minimizing your losses & maximizing profits.

Our cutting-edge insurtech solution, paired with either in-agency or out-of-agency insurance coverage, empowers you to deliver exceptional value and protection for your clients as their trusted advisor.

Does Your Insurtech Deliver?

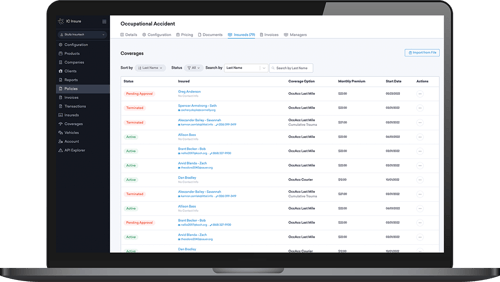

We deliver the only all-in-one technology solution for managing your clients’ independent contractor workforces and their insurance policies efficiently and compliantly.

-

Automatic Policy Documents: No more manual spreadsheets. Collect, store and distribute all policy documents digitally, from one convenient place.

-

Eliminate Billing Discrepancies: The Openforce platform handles billing calculations so you can rest easy knowing discrepancies are a thing of the past.

-

Reduce Errors and Omissions (E&O) Exposure: Minimize the risk of E&O to protect your business from costly mistakes and legal liabilities.

Openforce delivers the only all-in-one technology solution for managing your clients' independent contractor workforces and their insurance policies efficiently and compliantly. To see more, download the comparison.

Award-Winning Insurtech You Can Trust.

We are proud to be at the forefront of insurtech and insurance policy management software as the winner of multiple Stevie awards, including:

- Technical Innovation of the Year

- Emerging Technology

- Payments Solution

- Insurance Solution

- Achievement in Product Innovation

Learn Why Insurance Coverage with ICM Insurance Services is the Best Option.

In-Agency & Out-of-Agency Insurance Coverage Options.

Our insurtech solutions empowers your clients to enable insurance coverage directly through contractor management workflows. Just like with medical insurance, they can either opt for 'in-agency' or 'out-of-agency' coverage. To learn more about the six lines of insurance ICMIS offers, download the overview.

In-Agency Insurance (Includes ICMIS Coverage)

With six different insurance offerings, ICM Insurance Services (ICMIS) provides comprehensive coverage. In-agency coverage has numerous benefits.

Benefits Include:

- Custom Insurance Programs

- Lower Cost to Client

- Shortened Underwriting Process (Days vs. Weeks)

- No Down Payment or Chasing Premiums

- World-Class Claims Support

Out-of-Agency Insurance (Includes Non-ICMIS Coverage)

As a broker, we understand you may already have insurance programs in place. They too can be integrated into our insurtech solution for easy insurance policy management.

Benefits Include:

- Chance for Higher Upfront Commission

- Consumers Like Choices

- Supports Established Relationships/Programs

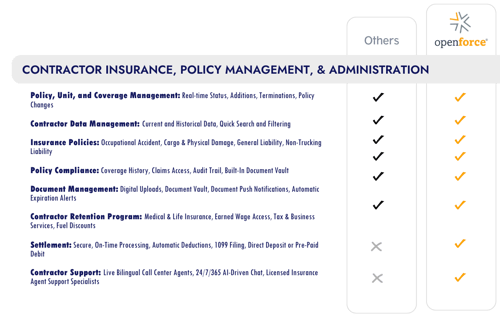

Does Your Insurance Agency Deliver?

When insurance companies and brokers partner with ICMIS, we handle the heavy administrative lifting — more so than other agencies. To see more, download the full comparison.