Unfortunately, Openforce is not qualified to provide you with tax advice; however, business expenses are generally tax-deductible, and the CMS Fee is an expense that you incurred while operating your business. You’ll want to speak with a tax preparer about what constitutes a legitimate deduction.

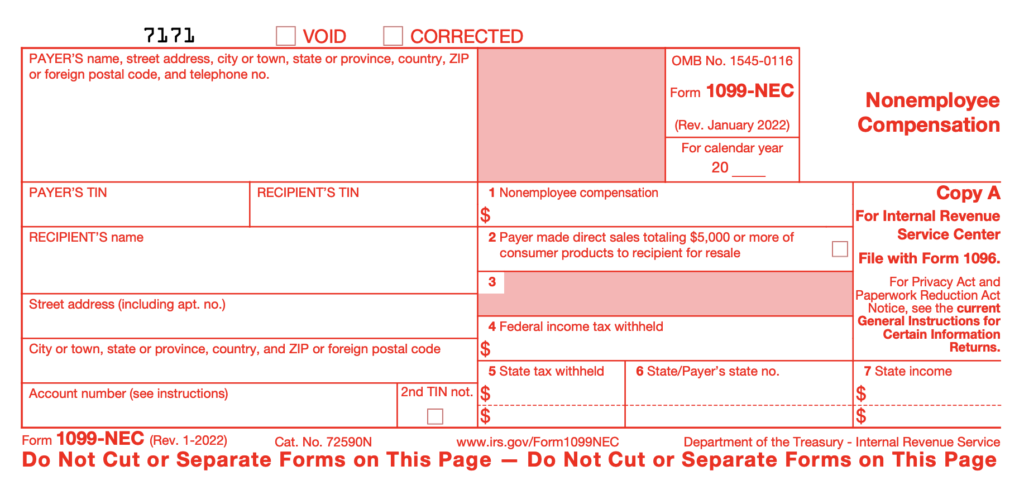

How Openforce will populate your 1099-NEC form:

Payer: Openforce/Contractor Management Services or your contracting company will be listed in this box.

Payer TIN: The EIN for Openforce or your contracting company will be listed in this box.

Recipient’s TIN: Your SSN or EIN will be listed in this box. This is based on data you provided during enrollment in Openforce.

Account Number: Openforce will populate an internal reference number in this box. No action is required from you.

Box 1: Non-employee compensation of at least $600.

Box 4: Federal income tax withheld. If you were subject to a federal withholding during the year, then the total of the withholding will be listed in this box.

Box 5-7: State tax-specific information.

Void/Corrected: If Openforce cancels your 1099, then the Void box will be checked. If Openforce changes the Non-Employee Compensation on your 1099, then the corrected box will be checked.

For more detailed information, visit the IRS website.