The rise of the on-demand economy, part of a broader long-term growth trend in the contingent workforce, is expected to reach 43 percent by 2020. This means millions of new independent contractors operating as independent businesses will be required to have some type of business insurance. Some coverages are mandated by the companies they contract with, some mandated by upstream contracting companies, some manadated by law, and yet others simply advisable from a business/personal protection viewpoint.

Whether you already run an independent business, are thinking about becoming a 1099 contractor, or own a company that works with independent contractors—the information that follows will help you understand the types of insurance coverages that both companies and contractors should have in place to operate in a best-practice protected manner.

Ideal coverages and why you need them

If you own a company that regularly deploys 1099 contractors, industry best practices may suggest that those contractors procure and maintain at least some form of the commercial insurance coverage described below, in place for any services they provide to, or on behalf of your organization. The IC coverages many times work together with your own coverages to provide multiple layers of protection.

The Workers’ Compensation Triad

One of the most complex areas of insurance for contingent workforces involves the triad of coverages related to Workers’ Compensation and Occupational Accident. These twin coverages, and the related Contingent Liability coverage, all operate together to provide accidental injury coverage to employees and independent contractors—and to ensure that each worker type is routed to the correct coverage. Workers’ Compensation provides wage replacement and medical benefits to hired employees whereas Occupational Accident Insurance provides similar benefits, but to independent contractors and their own subcontractors.

Keep in mind that there are other insurance policies that may be required and requirements vary from industry to industry.

Workers’ Compensation

Workers’ Compensation insurance is a legal requirement in most states if you have one or more employees. But, what about independent contractors?

If you’re an independent contractor with no employees, you are generally not legally required to carry Workers’ Comp for yourself. However, there are exceptions depending on the state or type of business industry you provided services for.

If you’re contracting company, it is important to ensure that independent contractors purchase their own accidental injury insurance—and for independent contractors this coverage many times is supplied in the form of Occupational Accident coverage (see below). This coverage will respond to pay any medical bills, disability payments, injuries or wage replacement they sustain or require while providing a client with their services.

Some companies opt to cover independent contractors within their own Workers’ Comp policy. However, if you operate a business in an industry where the likelihood of injury to contractors is high (logistics, construction, manufacturing), you likely want to avoid including contractors on your company’s policy as their claims can adversely affect your rate for years. In addition, coverage of ICs with your own employee Workers’ Comp coverages may cause confusion, leading to misclassification claims (ICs claiming employee status).

Occupational Accident

Occupational Accident insurance helps to cover independent contractors who are injured while under contract for a specific job. This type of coverage can help pay for medical bills, death benefits and replace certain lost wages. Businesses that enable Occupational Accident insurance coverages for ICs can protect themselves from expensive and time-consuming claims by independent contractors seeking employee benefits under the company’s Workers Comp policy. Limits in coverage allow organizations to manage costs and independent contractors can have peace of mind that they are protected.

Notably, while contracting companies may help enable procurement of Occupational Accident coverage, it is typically the independent contractor and related subcontractors that opt into such coverages and pay the related premiums. Keeping track of such coverages for all independent contractors in a contingent workforce, payment of premiums and cancellations can be a major challenge for companies wanting to ensure that all working ICs maintain Occupational Accident coverage. Furthermore, contracting companies typically would not want to be in the business of providing or managing such insurance coverages—once again risking misclassification claims.

Contingent Liability

Contingent Liability insurance protects a contracting company should an independent contractor claim to be an employee and sue to be covered under the company’s workers comp policy. Contingent Liability insurance pays for reimbursements should the ‘worker’ win his or her settlement and for court costs the contracting company incurs, providing a shield against the company’s Workers Comp policy even in the event of such a “loss”.

While a contracting company may see benefits from selecting Occupational Accident insurance over Workers’ Compensation, there are several risks involved with relying on minimum coverage alone. An independent contractor may get into an accident and claim to be an employee of the company in an attempt to collect Workers’ Compensation benefits. Even though the company reimburses the contractor in the form of Occupational Accident benefits, it may not cover all the medical expenses to the same extent as Workers’ Comp coverage. As a result, the independent contractor may insist on the larger payment that Workers’ Comp provides. Companies utilizing a high number or percentage of independent contractors should consult with counsel to ensure that reasonable limits are set for required Occupational Accident coverage.

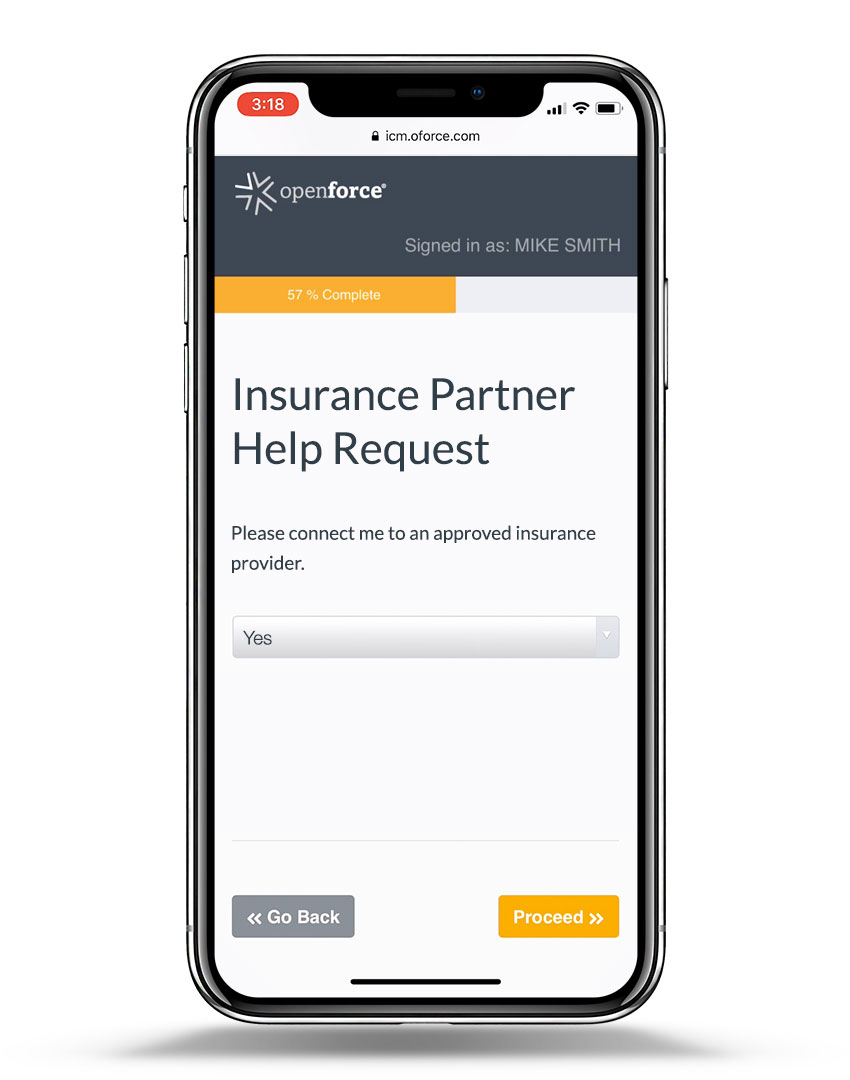

Openforce insurance enablement

At Openforce, we’ve made it simple, fast and affordable for businesses and independent contractors to purchase coverages through partner-broker programs and manage the insurance coverages they need to be effective through:

- Affordable Occupational Accident, Contingent Liability and Workers’ Comp options

- Insurer-broker agnostic programs and ability to connect to multiple insurance partner options

- Openforce’s 1099 platform helps ensure every ICs coverage is in place, verified and maintained

- Settlement deductions simplify payment and maintains ongoing coverage

Furthermore, we help properly validate and track the coverage for independent contractors, which is critical for compliance. Companies should always keep updated certificates of insurance, or proof of insurance, on file to confirm that the contractors not only have coverage in place, but that they haven’t missed payments which can cause the insurance to lapse.

Learn more about our insurance enablement solutions and other powerful independent contractor management platform features that help our customers onboard, manage, pay and retain their 1099 workforce.

About Openforce

Openforce is the leader in technology-driven services that reduce operating costs and mitigate risk for companies using independent contractors. Our cloud-based applications help companies and contractors alike achieve more sustainable, profitable growth by removing financial, operational, and compliance barriers to getting business done.