1099 Basics & FAQs

Browse these frequently asked questions about 1099 forms to help you find out when and where to locate them in your Openforce portal, plus other helpful tax form information.

You can verify your address in the Openforce portal and make any necessary corrections for future mailings. Address information will not be corrected on 1099 forms. You can access an electronic copy from the portal.

Need help viewing or updating your address? Here is a helpful step-by-step guide.

We only issue one printed 1099, if applicable, for each recipient. But you can print a copy of your 1099s from the Openforce portal.

Need help finding your 1099? Watch this how-to video for step-by-step instructions.

View and download 1099s and settlement history from Openforce.

Unfortunately, Openforce is not qualified to provide you with tax advice; however, business expenses are generally tax-deductible, and the CMS Fee is an expense that you incurred while operating your business. You’ll want to speak with a tax preparer about what constitutes a legitimate deduction.

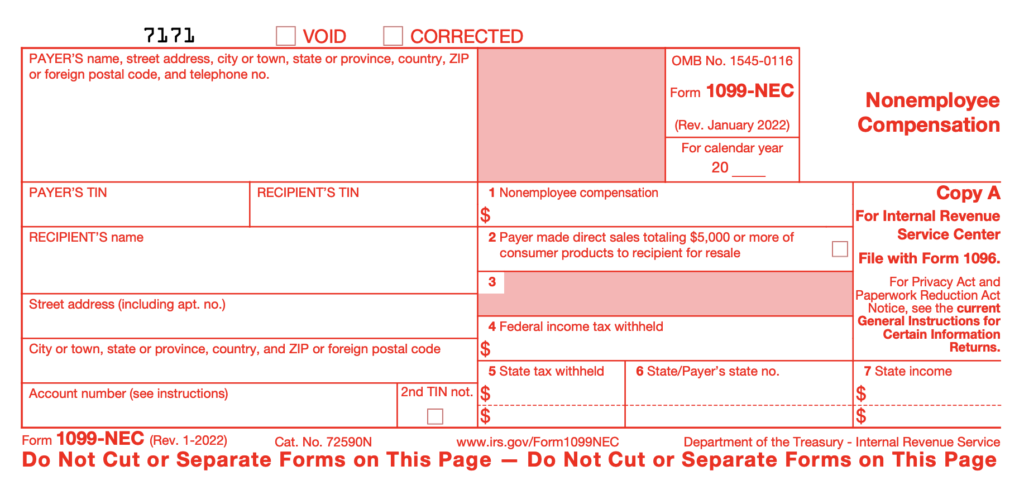

How Openforce will populate your 1099-NEC form:

Payer: Openforce/Contractor Management Services or your contracting company will be listed in this box.

Payer TIN: The EIN for Openforce or your contracting company will be listed in this box.

Recipient’s TIN: Your SSN or EIN will be listed in this box. This is based on data you provided during enrollment in Openforce.

Account Number: Openforce will populate an internal reference number in this box. No action is required from you.

Box 1: Non-employee compensation of at least $600.

Box 4: Federal income tax withheld. If you were subject to a federal withholding during the year, then the total of the withholding will be listed in this box.

Box 5-7: State tax-specific information.

Void/Corrected: If Openforce cancels your 1099, then the Void box will be checked. If Openforce changes the Non-Employee Compensation on your 1099, then the corrected box will be checked.

For more detailed information, visit the IRS website.

- The 1099 is a gross report. Deposits have deductions.

- If your contracting company is the payer of record (POR), they may have provided additional settlement data.

- Some pay types in the system are classified as non-reportable, so they will not be included in the 1099.

A payer of record is the party responsible for paying your settlements and for filling out the appropriate 1099 tax form and sending it to you.

The IRS 1099-NEC form is the form that is used to report independent contractor income to the IRS. NEC stands for Non-Employee Compensation. The requirements for reporting are as follows:

- You were paid $600 or more during the calendar year.

- Services performed by you were for business purposes.

- Corporations are generally not issued a 1099-NEC and not required by the IRS.

Your 1099 will be made available by January 31st of each year. A paper copy will be mailed to you, and you can find an electronic copy in the Openforce portal.

Need help finding your 1099? Watch this how-to video for step-by-step instructions.

View and download 1099s and settlement history from Openforce.

Your 1099 will be made available by January 31st of each year. An electronic copy of your 1099 can be found in the Openforce portal.

- Log in to your Openforce portal.

- In the navigation menu, click Tax Documents.

- Click the document link to view and download your 1099.

Need more help? Watch this how-to video for step-by-step instructions.

View and download 1099s and settlement history from Openforce.

A 1099-NEC form was issued to you if you met the following requirements:

- You were paid $600 or more during the calendar year.

- Services performed by you were for business purposes.

- Corporations are generally not issued a 1099-NEC and not required by the IRS.

There are a few reasons why you may not have received a 1099 form. To qualify for a 1099 form, you must have made at least $600 in the calendar year. If you made at least $600 and you were registered as a C or S corporation then a form was not generated because the IRS does not require forms to be generated for corporations. As an alternative you can provide your tax preparer with your settlement report.

Watch this how-to video for step-by-step instructions on accessing your settlement report